Creative Money LLC is a Seattle-based professional financial planning firm. Their team consists of highly trained professionals who are passionate about helping their clients achieve financial independence. Mindy Crary, the founder of the company, holds a master's level in business administration. Mindy has more than two decades experience in large financial services. She holds professional coaching certifications.

Only financial advisors can provide advice

Only advice-only financial advisors can offer financial planning in Seattle. They can advise clients on how to invest their portfolio and make suggestions but not push clients into particular investments. They do provide valuable information about investment options, however. Many clients have reservations about these advisors.

Hiring a financial advisor is a great way to create a long-term investment strategy. A financial advisor can help create an investment strategy that will help achieve your financial goals. A financial advisor who is local to Seattle will be familiarized with the economy and details about the businesses in the region.

Financial advisors who charge a fee

There are two types Seattle financial advisers: fee-based advisors and fee-only. An advisor who is fee-only is paid by clients. This is unlike a fee dependent financial advisor who receives incentives and commissions from financial product companies. Inherent conflict of interest is a result. A fee-only financial advisor must also act in the best interests of their clients.

Fee-based advisors will charge a fee which varies depending on the client. While fees for services vary from $600,000,00-$1 million, it is often based upon the client's net wealth. Many fee based financial advisors offer comprehensive wealth management services in Seattle. Fee-based advisors in Seattle can help with portfolio management as well as tax planning, estate planning and retirement planning.

Wealth management companies

Seattle wealth management firms provide a range services including financial planning, investment management, and other financial services. They work with individuals and companies of high net worth to help them achieve their financial goals. They can offer customized financial management strategies and investment strategies to suit each client's individual financial situation.

Miller Advisors, a free-standing wealth management company that charges no fees, is one of the best wealth management companies in Seattle. The firm offers complete services such as investment management and retirement planning. The firm is composed of certified financial and legal planners as well estate planners. The team has extensive experience helping families manage their financial needs, and has a combined 50 years of experience.

The cost of working as a financial advisor

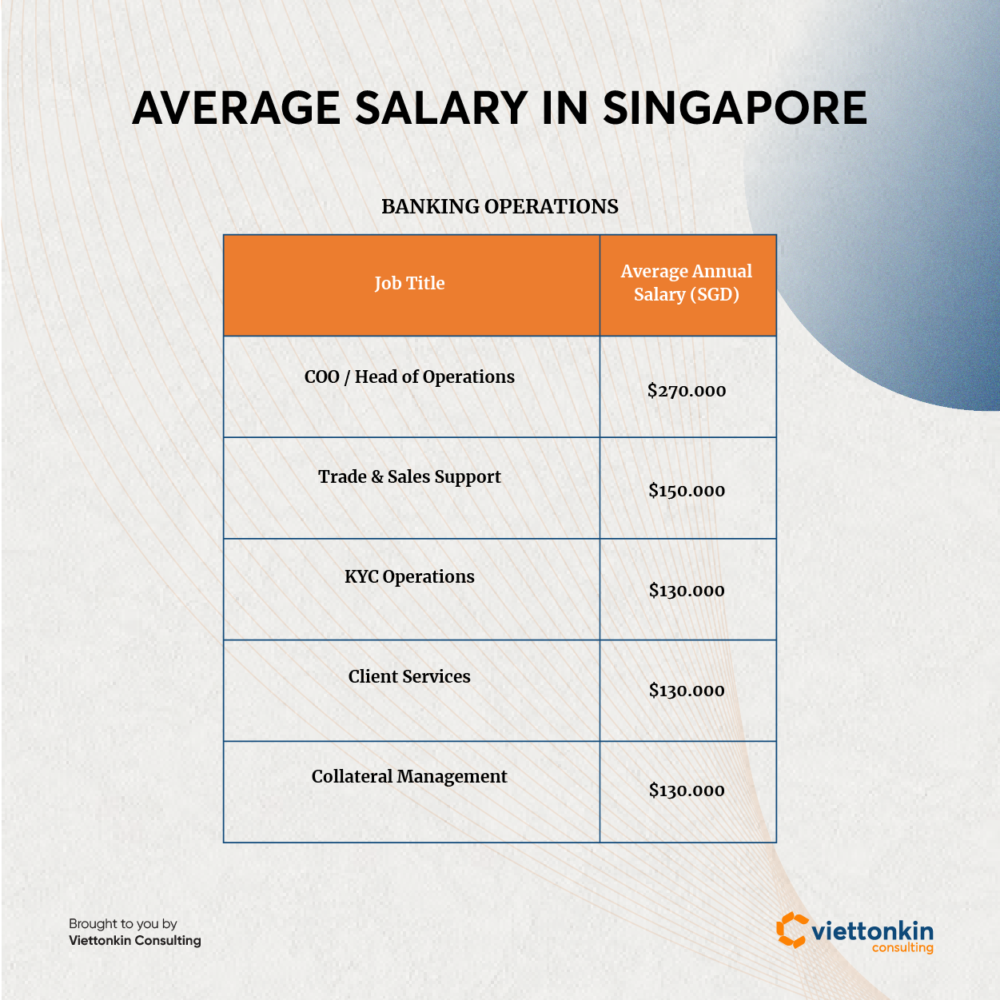

Fees for financial advisors vary depending on whether the fee is hourly or fixed. Some charge an annual fee of one percent of the AUM, while others charge by the hour. Asset management fees vary from about $230 an hr to as high as $7,500.

It's important to know how much each advisor will charge before hiring one. Some advisors charge an hourly rate for services you might not use. You may also have to pay a onetime fee to answer certain questions. Good financial advisors will want to build a long-term relationship.

FAQ

How do I choose a consultant?

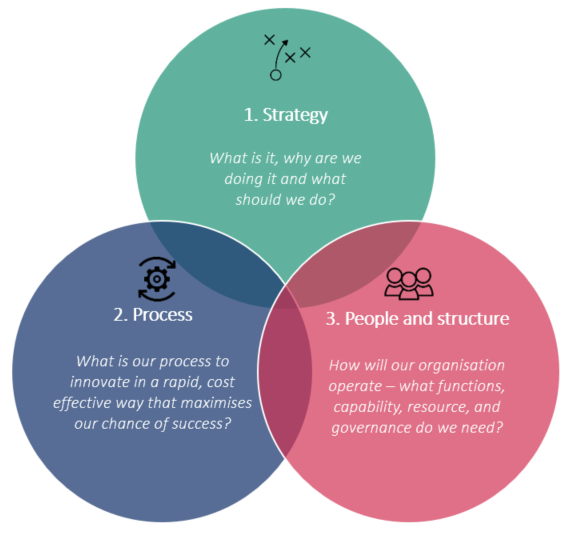

There are three major factors you should consider:

-

Experience - How much experience does this consultant have? Are you a beginner or an expert? Do her qualifications and knowledge show on her resume?

-

Education - What did he/she learn in school? Did he/she take any relevant courses after graduating? Were there any evidences of this learning in his/her writing?

-

Personality: Do you like this person or not? Would we like him/her to work with us?

-

The answers to these questions help determine if the consultant is right for our needs. If the answers are not clear, it may be worthwhile to interview the candidate in person to get more information about them.

What qualifications are necessary to become a consultant

It doesn't suffice to hold an MBA. You also need to be able and willing to work as a business advisor. You must have at least two years' experience working in consulting and/or training within a large company.

You should have had experience working with senior management to create strategy. This requires you to feel confident presenting ideas to clients, and getting buy-in.

A professional qualification exam like the Certified Management Consultant (CMC), Chartered Management Institute, is required.

Who hires consultants

Many organizations have consultants who help them with projects. These include small businesses, large companies, government agencies and non-profits.

These consultants may work directly for the organization, or freelance. The process of hiring depends on the size and complexity the project.

There will be many rounds of interviews for consultants when you are looking to hire. Only then can you select the right person to fill the position.

Is it necessary to pay taxes on consulting income

Yes. Taxes will be charged on consulting profits. It depends on how much income you make per year.

If you are self-employed, expenses can be claimed on top of your salary. These expenses include rent, childcare and food.

However, you can't deduct interest payments for loans, vehicle depreciation or the cost to purchase equipment.

If you earn less than PS10,000 per year, 25% can be claimed back.

But even if you're earning more than this threshold, you might still be taxed depending on whether you're classed as a contractor or employee.

The tax system for employees is PAYE (pay-as-you earn), while VAT is applied to contractors.

Do I really need legal advice?

Yes! Yes. Many consultants will create contracts for clients without seeking legal advice. This can lead to issues down the road. For example, what happens if the client terminates the agreement before the consultant's completion date? What happens if the consultant doesn’t meet the deadlines specified in the contract.

Avoid any legal issues by speaking with a lawyer.

What are the benefits to being a consultant?

As a consultant, you can usually choose when you work and what you work on.

This allows you to work wherever and whenever you want.

It also means you can easily change your mind without worrying about losing money.

Finally, you are able to manage your income and make your own schedule.

How long does a consultant take?

The amount of time needed depends on your industry and background. Most people start out with a few months before they find work.

However, some consultants spend several years honing their skills before finding work.

Statistics

- 67% of consultants start their consulting businesses after quitting their jobs, while 33% start while they're still at their jobs. (consultingsuccess.com)

- According to IBISWorld, revenues in the consulting industry will exceed $261 billion in 2020. (nerdwallet.com)

- My 10 years of experience and 6-step program have helped over 20 clients boost their sales by an average of 33% in 6 months. (consultingsuccess.com)

- Over 62% of consultants were dissatisfied with their former jobs before starting their consulting business. (consultingsuccess.com)

- Over 50% of consultants get their first consulting client through a referral from their network. (consultingsuccess.com)

External Links

How To

What does a typical day look like for a consultant?

The type of work that you are doing will affect the typical day. You will be spending time researching, planning new ideas, meeting with clients, and creating reports.

You will have many meetings where clients and you can discuss their issues. These meetings may be over the phone via email, on-line, or face-to–face.

Also, proposals are documents that outline your ideas or plans for clients. These proposals should be discussed with a mentor or colleague before being presented to clients.

After all the preparation and planning, it's time to actually create some content. For example, you could be writing articles, designing websites, creating videos, editing photos, or conducting interviews.

Based on the scope and complexity of the project you may need research to obtain relevant statistics. You might need to determine how many customers you have, and whether they buy more than one product.

Once you have collected enough information, it's now time to present the findings to your clients. You can present your findings verbally or in writing.

Finally, you must follow up with clients after the initial consultation. You might contact them regularly to check on their progress or send them emails to confirm they have received your proposal.

Although it takes time, this process is worth it. It's also important to keep your eyes on the prize and maintain good relations with clients.