Local businesses are a great place to start when searching for a financial advisor. Local businesses are able to provide employment and income, as well as funding public services like schools, police, and fire departments. They also contribute to a safer and more prosperous community. A local financial advisor can help you find the best investments to suit your needs.

Find a local advisor in financial services

You can find information about local financial advisers using the Financial Industry Regulatory Authority Website. It is important to note that each advisor's profile will not be detailed. While accreditation may indicate an adviser's expertise, it doesn't mean that they're the right advisor for you. They may have made it past the first round in the hiring process. You can also look at their websites and follow them on social media to get more information about their qualifications. Face-to-face meetings with advisers are a good idea before making any decisions.

Financial advisors are able to help you achieve your financial goals and avoid costly mistakes. They can help you protect your assets, increase your savings and invest your money wisely. Their help can help you take control of your finances. In addition, you can use the financial advisor matching tool at SmartAsset, which will match you with up to three advisors in your area. Each advisor can be interviewed free of charge so you can determine which one is the best for you.

Evaluation of the reputation of a financial adviser

It is vital to evaluate the reputation and credibility of any financial advisor. Ask yourself whether their goals and interests align with yours. Reputable advisors are ethical and put the clients' best interests first. They will also seek to minimize conflict areas.

Barron's Top advisors list is one way to evaluate an advisor's reputation. This list is compiled by state and ranks the best advisors. The assets they oversee, the revenue generated by those clients, as well as the quality and quantity of their practices are the criteria for selecting the top advisors in each state.

Getting referrals

Referrals are one the most valuable source of business. There are many ways to get them. The best way to get referrals is to concentrate on local professionals and business owners. These professionals can include accountants, attorneys, and personal bankers. But referrals from other types can also be very effective. You can also get referrals from local chamber chairpersons and local radio personalities. If you live in a smaller community, it is worth contacting engineers, architects, or other professionals in that field.

Referral networks are another effective way of increasing referrals. Referring potential clients to others in the same field can be done through this network. This can help you get more clients and secure your local market.

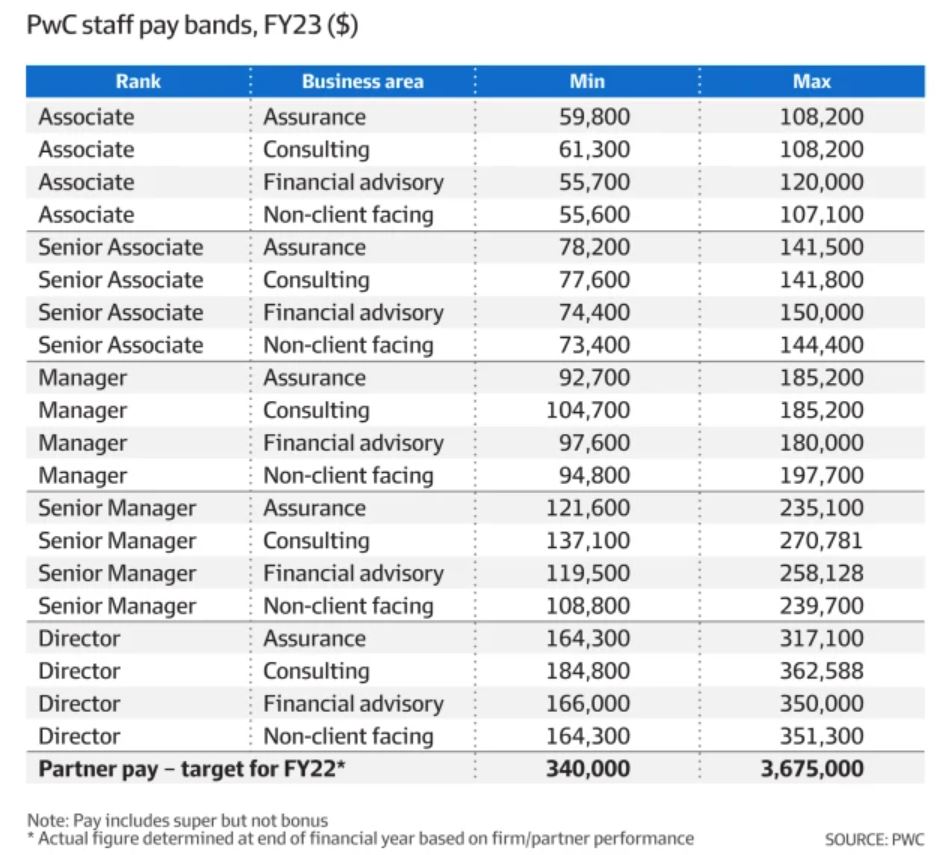

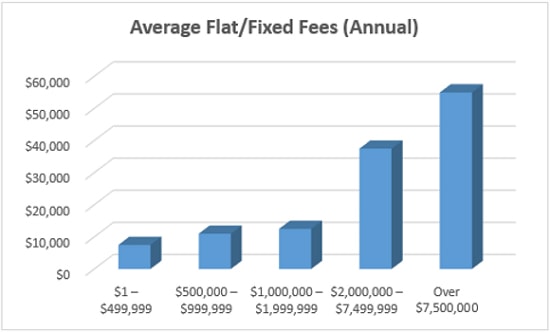

Finding out how to pay an advisor's salary

It is important to understand the fees charged by financial advisors when searching for one. Many advisors charge an annual and monthly fee. Depending on the service, these fees could range from $50 to $500 per monthly. A few subscription services require a one-time payment and then you pay monthly to continue receiving support. Some subscription services include reviews and annual meetings. You may also be able to spend a limited amount time one-on-one with your advisor. It is worth noting that you can also have unlimited access for a set fee.

A second way to find local fee -only financial advisors to help you is through the internet directories. You can browse local advisors through these directories. These professionals are NAPFA-registered and have met stringent standards of experience, fiduciary duty, and other requirements.

FAQ

Do I need a degree to be a consultant?

You can become an expert in any subject by learning the subject thoroughly, then applying what you have learned.

Start studying today if you want the skills to be a great manager!

Employers may be reluctant to hire people with a degree, but not the relevant experience. If you can show that your education is comparable to the job applicants, you may still be eligible for employment.

But remember, employers will always look for candidates with real-world expertise.

Who hires consultants

Many companies hire consultants to help with their projects. These can include small businesses and large corporations, government agencies as well non-profits and educational institutions.

Some consultants work directly for these organisations, while others freelance. The hiring process for both cases varies depending upon the project's size and complexity.

You will likely go through multiple rounds of interviews when hiring consultants before you choose the candidate you feel is the best fit for the job.

What is the difference of a consultant versus an advisor?

A consultant provides advice on a topic. A consultant offers solutions to problems.

Consultants work directly with clients to help them reach their goals. Clients are referred to advisors through books, magazines and lectures.

Statistics

- Over 62% of consultants were dissatisfied with their former jobs before starting their consulting business. (consultingsuccess.com)

- "From there, I told them my rates were going up 25%, this is the new hourly rate, and every single one of them said 'done, fine.' (nerdwallet.com)

- So, if you help your clients increase their sales by 33%, then use a word like “revolution” instead of “increase.” (consultingsuccess.com)

- Over 50% of consultants get their first consulting client through a referral from their network. (consultingsuccess.com)

- On average, your program increases the sales team's performance by 33%. (consultingsuccess.com)

External Links

How To

How To Start A Consultancy Company, And What Should I Do First?

A consulting business is a great way of making money online. You don't need any previous business experience or investment capital. To start your own consulting business, you can build a site. To promote your services, you will need to create a website.

You can create a marketing strategy that includes these things with these tools

-

Create content (blogs).

-

Establishing connections (contacts)

-

Generating leads, also known as lead generation forms

-

Selling products online

Once you've created your marketing strategy, the next step is to find clients who are willing to pay you for your services. Some prefer to meet up at networking events or go to meetings, while others prefer to use online platforms like Craigslist, Kijiji, and others. It's up to you to make the decision.

Once you have found clients, you should discuss terms and payment options. You can discuss hourly rates, retainer agreements, flat fees, and other options. You need to be clear about what you expect of a client before they accept you as a client.

An hourly agreement is the most common contract for a consulting service. This agreement allows you to agree to provide services at a fixed price each week or month. You may be eligible to negotiate a discount, depending on the service that you offer. Make sure you understand what you are signing when you accept a contract.

Next, create invoices for your clients and send them. Invoicing is one thing that looks simple until it's actually done. There are many ways to invoice clients. It all depends on your preference. For instance, some prefer their invoices to be emailed directly to clients while others prefer hard copies to be mailed. Whatever your preferred method, make sure it works well for you.

After you've created your invoices, you can collect payments. PayPal is popular because it is easy to use, offers several payment options, and most people prefer it. You can also use Square Cash, Square Cash (Google Wallet), Square Cash, Square Cash, Apple Pay and Venmo as payment processors.

Once you're ready and able to collect payments, you should set up bank accounts. Separate savings and checking accounts will allow you to track your income and expenses independently. When paying bills, it is also beneficial to set up automatic transfer into your bank account.

Although it can seem daunting when you first start a business as a consultant, once you get the hang of it, it will become second nature. You can read our blog post to learn more about how to start a consultancy business.

Starting a consulting firm is a great way to earn extra cash without worrying about employees. Many consultants work remotely. This means that they don’t have to deal in office politics or work long hours. You have more flexibility than traditional employees because you aren't tied down by work hours.